KYC & AML Onboarding Software for Regulated Teams

KYC/AML Checks Embedded in Your Onboarding Workflows

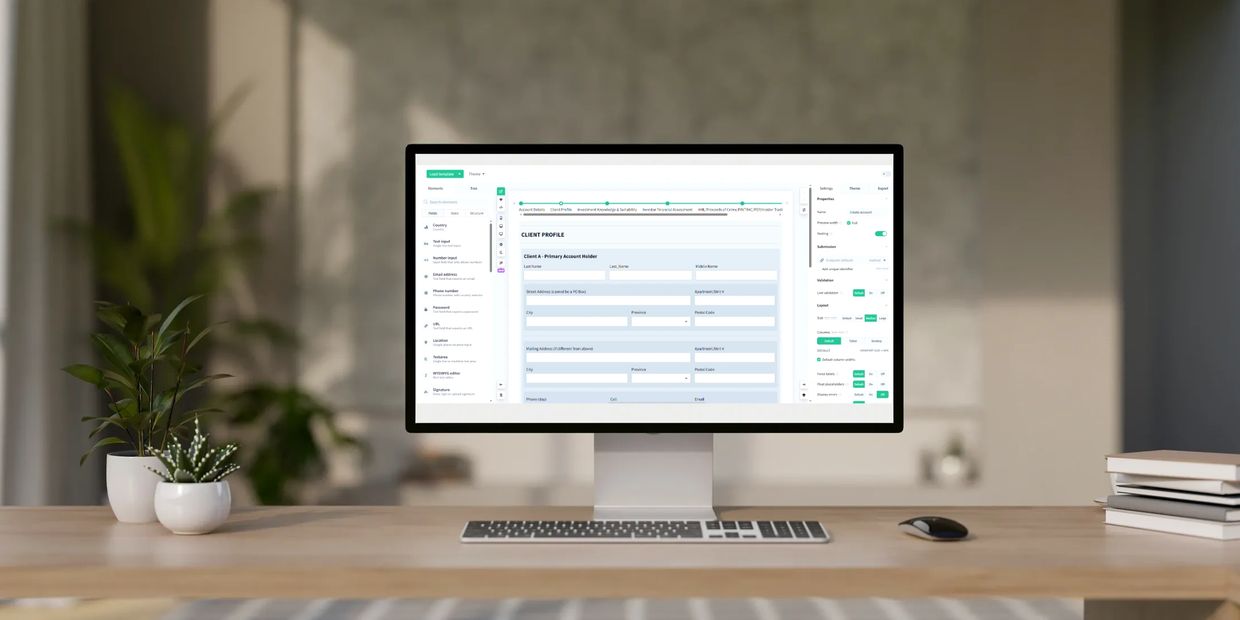

FormIQ brings KYC onboarding, AML checks, and customer due diligence into one unified onboarding platform. Instead of switching between portals for forms, ID checks, and screening, your teams work from a single workflow that is designed for regulatory pressure and complex account structures.

From simple retail clients to high-risk entities and complex ownership structures, FormIQ helps ensure that every onboarding case follows the right policy—and produces audit-ready evidence as it goes.

Book A Demo Today

Automate your onboarding processes and streamline documentation intake with FormIQ. Contact us for a demo of the platform.

From Fragmented KYC Processes to a Single System of Record

Many organizations still manage KYC/AML onboarding with:

- Manual PDFs and email attachments

- Separate ID verification portals and spreadsheets

- Ad-hoc approvals and inconsistent documentation

- Limited visibility into what checks were actually performed

- Compliance requires full audit trails and clear accountability

FormIQ replaces these fragmented tools with a centralized onboarding record that includes data, documents, signatures, screening outcomes, and approvals for each customer or account.

Powerful KYC, AML, and CDD Capabilities

Integrated Identity & Document Verification

FormIQ’s KYC & AML Onboarding module is designed to work with your preferred providers while keeping a single workflow and audit trail.

- Orchestrate ID verification (e.g., government IDs, selfies, liveness checks) as a step in the onboarding flow.

- Capture and verify documents such as proof of address, corporate documents, financial statements, and trust documents.

- Validate fields and documents at the point of capture to reduce back-and-forth with clients and intermediaries.

- Store verification outcomes as part of the onboarding record alongside timestamps and reviewer details.

Customer Due Diligence (CDD & EDD)

Use FormIQ to define and enforce your KYC policy in a structured way:

- Configure Customer Due Diligence (CDD) questionnaires and data collection based on customer type, product, and geography.

- Automatically trigger Enhanced Due Diligence (EDD) when certain risk indicators are present (e.g., PEP status, high-risk jurisdiction, unusual transaction profile).

- Capture documentation and explanations required for higher-risk cases inside the same onboarding workflow.

- Route EDD cases to senior reviewers or specialized compliance teams with clear accountability.

This approach helps make sure that your onboarding workflows reflect your written KYC/AML policy—and that you can prove it during audits.

Screening, Risk Scoring & Approvals

FormIQ supports the full lifecycle of KYC/AML checks—inside the onboarding experience:

- Integrate with watchlist and sanctions screening tools as part of the workflow.

- Capture results for PEP, sanctions, and adverse media screening in the onboarding record.

- Apply configurable risk scoring based on customer answers, documents, geography, and screening outcomes.

- Route cases for additional review or escalate to senior compliance teams when risk thresholds are exceeded.

Approvals (or rejections) are recorded with timestamps, user IDs, and comments, forming part of the compliance-ready audit trail.

KYC and AML Onboarding Designed for Regulated Industries

Capital Markets

Capital Markets

Capital Markets

New client account forms, complex accounts, suitability, and investor verification

Financing

Capital Markets

Capital Markets

Borrower onboarding, credit checks, and beneficial ownership verification

Insurance

Capital Markets

Real Estate

KYC/KYB procedures for policyholders, intermediaries, and high-risk products

Real Estate

Real Estate

Real Estate

AML, ID, and documentation checks for buyers and sellers of real estate

Healthcare

Real Estate

Healthcare

Insurance verification, medical certificate and education checks, and ID confirmation

Legal

Real Estate

Healthcare

Customer Due Diligence (CDD), entity onboarding, beneficial ownership collection

The Benefits of KYC/AML Automation for Compliance

Single Source of Truth

All KYC data, documents, screenings, and approvals live with the onboarding record.

Stronger Controls

Enforce your KYC policy with configurable rules instead of relying on manual judgment alone.

Reduced Operational Drag

Fewer manual steps, fewer portals, and less re-keying of data.

Better Client Experience

One guided journey for your clients, advisors, or partners—even when the underlying checks are complex.

Audit Ready Evidence

Every step is logged with timestamps and user details for internal review and regulator questions.

KYC, AML, CDD Connected Directly to Client Onboarding

Onboarding Workflow Engine

Onboarding Workflow Engine

Onboarding Workflow Engine

Determine when and how KYC/AML steps are triggered in an onboarding workflow

Compliance & Audit Trails

Onboarding Workflow Engine

Onboarding Workflow Engine

Store the tamper-evident history of checks, decisions, signatures, and documents

Core Features

Onboarding Workflow Engine

Core Features

Smart forms, intelligent documents, and esignatures, on FormIQ’s secure platform

This website uses cookies

We use cookies and similar methods to recognize visitors and remember their preferences. We also use them to measure ad campaign effectiveness, target ads and analyze site traffic. By clicking 'accept,' you consent to the use of these methods by us and third parties.